Recapitalization ghost is coming back to hunt Greek banks just when climate was helping them to get back to markets seeking cash and better prices for their non performing loans assets. Yet another stunt pulled by the IMF over the timing and procedure of the stress tests, has left the four Greek systemic banks hanging by a thread, loosing billions out of their capitalization in less than a month and being run down by a harsh sell off the last two days.

Now Greece’s big four banks (Alpha Bank, Piraeus Bank, National Bank and Eurobank) are entering a prolonged state of shock and uncertainty, as the IMF’s demands for imminent new stress tests and Asset Quality Review (AQR) to be completed before the termination of the current program have set the stage on fire. Despite interventions from Mario Draghi and Victor Constancio, ECB’s vp and chairman, the situation is expected to get worse before it begins to clear up in October, at the IMF Convention in Washington.

IMF demands have met with strong resistance from the Greek government, bankers, ECB and the European Commission, but they have nonetheless put the banking system in turmoil, causing concern and fear to existing and potential investors.

Indicative of the situation are the losses of 30% the banking sector has taken in Athens Stock Exchange during the last two months and clearly depict the worsening climate and a credibility crisis on the making.

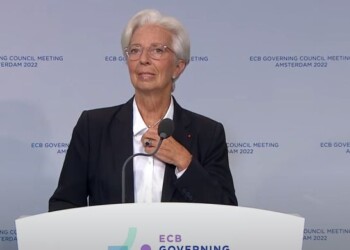

Even though the ECB has signaled that it maintains jurisdictional control over decisions about tests in Greek banks, its Vice President Victor Constancio had declared, during a joint press conference with Mario Draghi, that although there is no reason to perform a new AQR, ECB will try to accommodate the IMF’s demands as well.

Mario Draghi has also revisited the issue, setting the commencement of new stress tests for Greece’s four systemic banks in February, so that they are completed before the termination of the current program, while also offering a front-loaded scenario, in an effort to satisfy the IMF’s demands, minus the AQR, and to disperse concerns of the markets.

As Europe’s Central banker has stressed, Greek banks are to undergo the programmed stress test in the coming year and the IMF has been so informed by an SSM letter. Although this is a consistent ECB position, its repetition carries a lot of symbolic weight, in light of the Institutions being in Athens for the evaluation and in the aftermath of the German elections.

The AQR issue, however, is by no means closed, as it will be raised again during the IMF Autumn Meetings, where goals and procedures will be laid out. Besides, the third evaluation officially begins after the IMF Convention in mid-October in Washington.

The prospect of a new AQR has had a negative effect on Greek banks, with the bank sector suffering losses of 30% in Athens Stock Exchange during the last two months, which demonstrates the deteriorating state of banks’ balance sheets and the fear of a new recapitalization stemming from it.

The IMF has requested that the new stress tests and AQR are performed before completion of the current program, so that any additional needs will be covered by already available ESM funds that haven’t been used and may serve as “cushions” for that purpose.

The Greek government, the bankers, the European Commission and the ECT are opposed to the event of a new recapitalization, as this would send investors message of relapsing crisis, destroying investing prospects and sending the banking system in an inwards spiral. At the same time, this would raise once again the issue of NPL, a matter also high in the agenda for the IMF, which estimates that the business plans agreed upon are not yielding satisfactory results and the goals set are over-optimistic.

[infogram id=”greek_banks_npe_npls” prefix=”ba7″]